Making Surgical Robotics Easy, Affordable & Accessible.

With numerous technological advancements and increased funding for medical robot research, it’s no surprise that the surgical robotics space is expanding. By 2025, the market is expected to grow from its current value $6.7bn (2020) to $11.8bn.

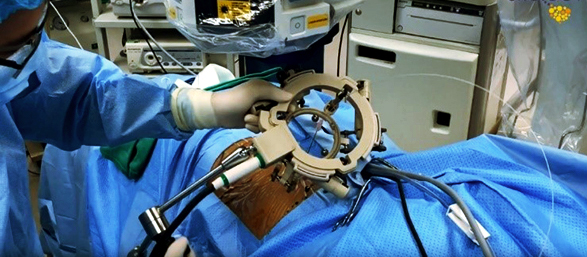

Robotic surgery allows surgeons to perform complex surgical tasks through tiny incisions using robotic technology.

Surgical robots are active, computer-controlled devices that can be programmed to aid in the positioning and manipulation of surgical instruments. This provides surgeons with better accuracy, flexibility and control. These advantages make surgery safer and improve patient outcomes.

An uptake in surgical robotics would also mean that fewer patients would be subjected to open (long incision) surgery, which allows surgeons to perform more complex surgeries in a shorter time.

Why NDR Turn Heads with Their Tech

NDR Medical Technology are a Singapore start-up making headway in this space, having won the 2019 MedTech Innovator Award as part of the Asia Pacific Competition.

Their pioneering technology focuses on Automated Needle Targeting (ANT), with the company ready to bring to market the world’s first robotic system with artificial intelligence (AI) and image processing for automated anatomical targeting.

The technology performs automated trajectory path alignments for surgeons and helps them navigate the needle from insertion point to the selected target with increased accuracy and precision. This has applications that will help expedite diagnosis for multiple critical illnesses.

In a recent conversation with Mr Alan Goh, the Co-founder & CEO at NDR, I learned about how they are hoping to develop the technology to allow for full automation, locating lesions in real time.

While the NDR technology is enough to turn heads on its own, the company’s disruptive approach to the surgical robotics market also has me intrigued - with the goal to make surgical robotics affordable,accessible and easy to use

New Opportunities in Asia-Pacific

Despite its clear advantages, the adoption of surgical robotics has been limited because of price. Even some of the more affordable robotics systems are valued at a minimum of $400K.

This has priced out many hospitals and limited the marketplace predominantly to the US - where market leaders Intuitive are based, as well as many exciting upcoming players like Vicarious Surgical, PROCEPT BioRobotics & Neocis.

However, NDR are breaking the mould and seizing opportunities in Asia-Pacific.

At NDR we intend to produce systems that are affordable which can be widely adopted. With the right pricing strategy, our technology can benefit a larger number of surgeons and patients. We can influence clinical outcomes especially in regions with large amount of underserved cases.

Their affordable pricing makes adoption in Asia-Pacific possible. China has an increasingly innovative and growing market for surgical robotics. NDR are not just riding, but generating this trend.

Their expansion into the region has been assisted by Microport, a global medical device developer and manufacturer. In July, Microport led a Series A funding round that raised $8m (SGD) for NDR, with additional investment from SGInnovate and Kava Ventures.

China is growing and there's so much opportunity. It gives smaller companies, like us, more opportunities to work with the market leaders and penetrate the entire market that way.

NDR will be establishing a joint venture in China with MicroPort, that will advance NDR’s entry into the Chinese market, tapping on existing networks and engineering resources that the partnership brings.

While the NDR pricing strategy is supporting adoption in Asia-Pacific, so is the ease-of-use for their technology.

I think for any system to be adopted, other than price point, the ease-of-use is what’s most important to hospitals. Most of the clinicians who have used our system were able to implement and understand how it functions within an hour. That’s helping us reach a wider market.

With ease-of-use improving and pricing becoming more accessible, adoption is increasing in Asia-Pacific and the market is becoming stronger year on year.

The Competition & the Future

Adoption of surgical robotics isn’t limited to Asia-Pacific. Both myself and Mr Goh discussed how the space is growing in the US and Europe. Recent investments in CMR Surgical saw the company reach a valuation of $1b, which is a reflection of the growth.

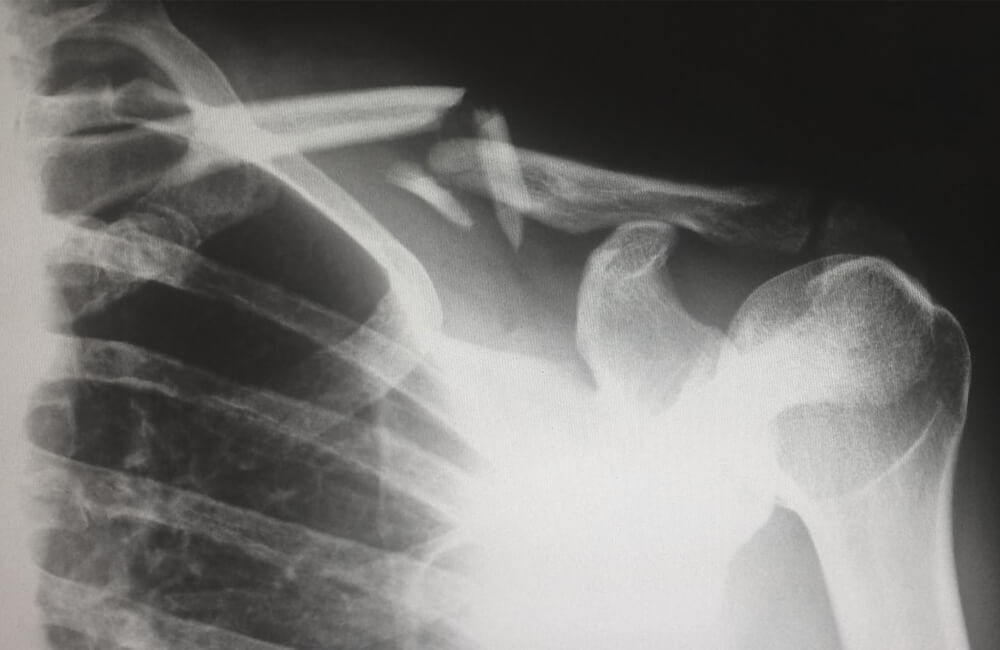

With increased adoption of surgical robotics in applications like orthopaedics too, it’s clear that confidence is growing and the space is becoming more accessible.

Recommended.

Innovative Spine & Orthopedic Implant Technologies to Watch.

Orthopedics isn’t necessarily a market commended for its digital innovation, but these five companies are proving differently with their latest product launches. Click to read more.

What Innovations Could Shape the Future of Orthopaedics?

To achieve personalised care in orthopaedics, we need advances in AI, surgical robotics, augmented reality (AR) and more! But where will this innovation come from? Click to find out.

3 Technologies Revolutionising Spinal Surgery.

New innovations have continued to advance surgery – especially within the spinal space. I wanted to highlight the revolutionary technology that is driving this change and shaping the future of the space.

How to Take Your Medical Device to Market.

In this episode, I'm joined by Steven Haken and Deborah Rizzi from market access and reimbursement specialists Odelle Technology to discuss how to take a medical device to market.

Comments.