Who'll Win the Race to Be the Next Medical Imaging Unicorn?

Announcing their North American launch in a big way, United Imaging undoubtedly stole the show at last year’s RSNA. They now have a full-suite of FDA-approved capital imaging products ready to challenge the established big three: Philips, GE and Siemens.

United Imaging are continuing to grow in the US and their native Asia, supported by Chinese domestic medical device policy. It’s only in Europe where expansion is slow.

With a $5bn valuation they’re in good company, sitting alongside medical imaging unicorns Butterfly Network and Heartflow.

These companies have three factors in common: global ambitions, a large market-size and truly disruptive technology.

There’s no perfect formula to becoming a successful billion-dollar company in medical imaging, or else we’d all be billionaires. However, this combination of ingredients does seem to create a common recipe for success.

Therefore, I’ve investigated the most likely contenders that share these qualities and have the potential to follow the path of Butterfly, Heartflow and United Imaging.

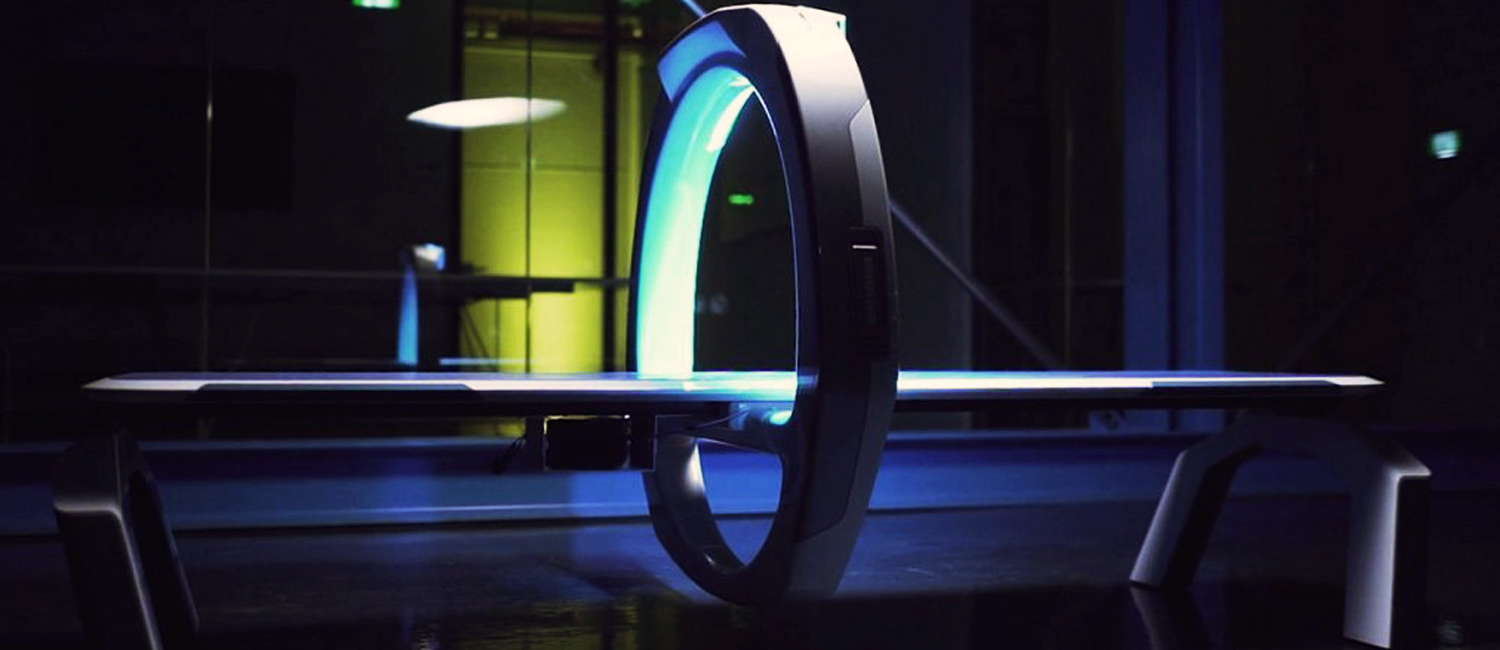

“The Favourite” - Hyperfine

If we’re looking for track records in this industry, they don’t come much more prolific than Jonathan Rothberg with his Butterfly leadership and previous work in Genetics.

His latest commercial company, Hyperfine, are to the MRI market, what Butterfly are to ultrasound. They’re bringing the modality to the Point of Care (PoC), with a competitive price point and some of the brightest brains behind the wheel.

Hyperfine claim their unit is 20 times cheaper to build, 10 times lighter and uses 35 times less power than a 1.5 Tesla MRI – creating a true paradigm shift in imaging.

Already filed with the FDA, Hyperfine are right up there as a favourite to become the next unicorn.

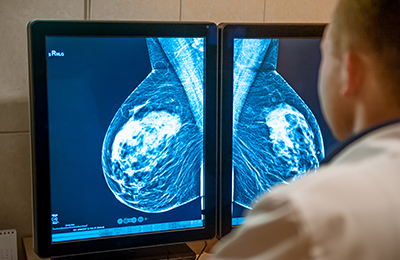

“The Big Hitter” - Viz.ai

With similar potential, Viz.ai are supported by a huge round of recent funding. Reaching $50m through Series B funding alone, they’ve raised close to $80m in total so far.

Their technology is equally disruptive, reducing the time it takes to diagnose and treat strokes.

Stroke is the leading cause of long-term disability in the US. This can be prevented with the technology’s early diagnosis, which has got investors excited. As well as being life-changing for patients, the technology will help save billions for healthcare providers in treatment costs.

With their CE Mark obtained, European expansion could sky-rocket their valuation. However, there’s been little signs of that yet. Watch this space.

“The Wildcard” - Germitec

Also with a CE Mark and their FDA approval on the cards for early 2020, Germitec have potential to rapidly expand.

Not strictly an imaging company, the growth of both traditional and PoC ultrasound is likely to see their technology become crucial to the industry.

Germitec’s Hypernova Chronos is the first photonic high-level disinfection (HLD) system which doesn’t pose any chemical risk, compared to its nearest rival – Nanosonics’ trophon2.

Focusing on developed markets, rather than the global, Germitec can dominate ultrasound disinfection and piggyback on the growth of this market.

“The Outsider” - NanoX

NanoX share similar potential - we’ve been waiting for them to come to market for a while.

For the last 15 years, a global team across Japan and Israel have been working on their 5D X-ray, but with good reason.

This is meant to be cheaper than existing technology and able to produce higher-quality images - with no motion artifacts another advantage. This is achieved by using 100 million nano-cones to produce the electron stream for X-ray without the use of heat.

In my conversations with Ran Poliakine, Founder and CEO of Nanox, he said: "Nanox is all about preventive healthcare. We believe cancer can be removed from the human condition if detected early and medical imaging is the best way today for early detection.

Nanox has an agenda to make medical imaging available for everyone and is delivering on the first ever hope for making preventive imaging a new standard of care."

Aiming to have 15,000 systems deployed globally by 2022, their ambition is clear. Expect FDA approval in early 2020.

You may be surprised that few AI companies have made my list. Despite the recent boom in AI start-ups commercialising, I believe clinical adoption will remain low. Too many AI companies are focussing on radiology niches, meaning the necessary mass-adoption for unicorn status is missing. Outside of Heartflow and Viz.ai, the best chances for any AI company to reach unicorn status could be via one of the dedicated AI marketplaces.

Recommended.

What Does Consumer Neurotech Innovation Mean for the Medical Device Industry?

Integrating systems into the human brain to control our everyday devices may seem very ‘Black Mirror’, but thanks to modern neurotechnology it's quickly becoming reality. Click to find out more.

How to Master Reimbursement in Medical Devices & Biotech.

In this live webinar, hosted by CM Medical, we went in search of expert reimbursement advice - speaking to Deborah Rizzi and Steven Haken of Odelle Technology.

How to Stand Out in a Saturated AI & Medical Imaging Market.

We asked an expert at an innovative medical imaging start-up about how they had overcome this challenge. Click now and listen to what they said.

Comments.