Why These 3 Surgical Robotics Companies are Intuitive's Biggest Threat.

Could the days of Intuitive Surgical’s market domination finally be coming to an end in general/laparoscopic procedures?

It’s certainly possible. More and more companies are entering the robotics market, expanding and competing within this space.

It’s a bold move to compete with Intuitive, considering the US company’s reputation in the market. Their pioneering Da Vinci robot has been the market leading system for nearly two decades.

Nonetheless, competition is increasing and becoming a threat.

It’d be easy for this article to talk about the likes of Medtronic, whose newly released Hugo RAS system is exciting everyone, and Johnson & Johnson, who’ve just acquired robotics specialists Auris Health. However, it should be an expectation for these industry giants to compete.

That’s why I’m keen to champion three emerging companies whose technology has led their ambition, rather than R&D budgets, mergers and acquisitions. Their progress has been fascinating to follow and I’ll be excited to see them soon competing with the likes of Intuitive:

CMR Surgical

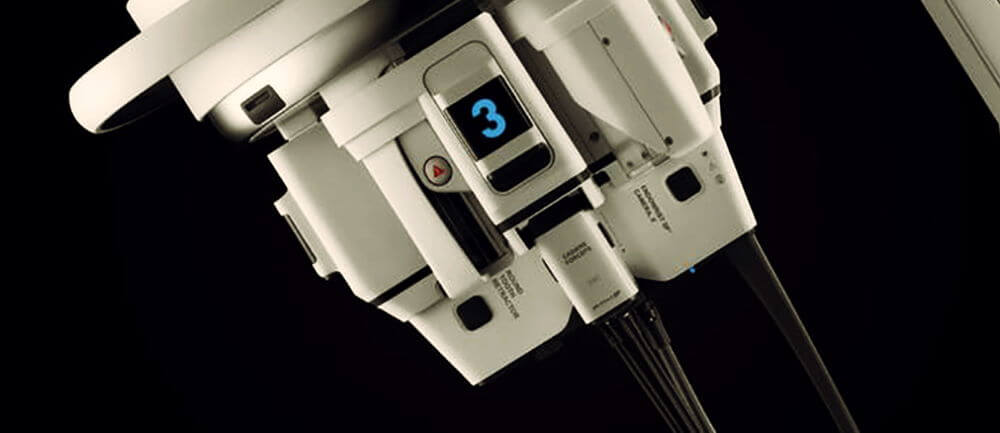

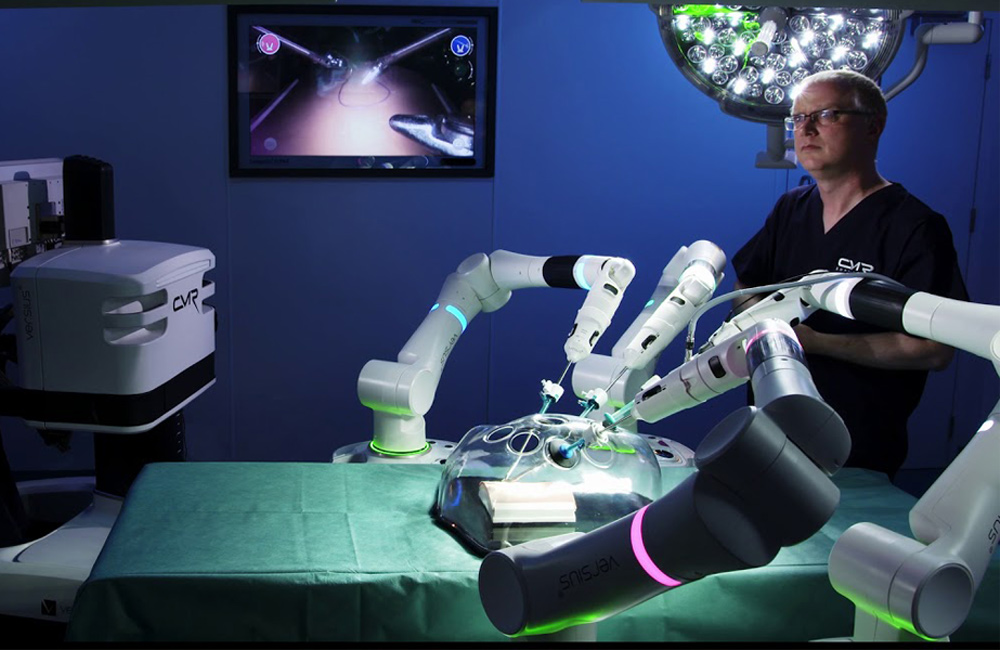

Versius, by CMR Surgical

Hiring aggressively with ambitious plans for the future, it’s impossible to ignore CMR Surgical.

They have just commercially launched their first product, the Versius surgical robot. This launch was supported by £195m worth of series C round funding, Europe’s largest ever private financing round in the medical technology sector.

The funding behind this product is a huge vote of confidence for CMR Surgical, with many experts believing it has the potential to transform minimal access surgery.

Versius gives surgeons the freedom of port placements, combined with the advantages of fully wristed instruments, 3D HD vision, natural instrument control and a choice of ergonomic working positions to reduce stress and fatigue.

It’s cost effective too. Quick to set up and take down, portable and flexible enough to handle a vast range of laparoscopic procedures, hospitals can improve utilisation and patient throughput with the system.

Its managed-service model removes the need for expensive capital outlay, offering a complete robotics programme for a guaranteed fixed annual cost over a multi-year life.

Clinical trials have taken place at Deenanath Mangeshkar Hospital in Pune, India, and the company have just announced their first two commercial sales. Following this, I expect to see rapid growth for CMR Surgical in the next three to four years.

DistalMotion

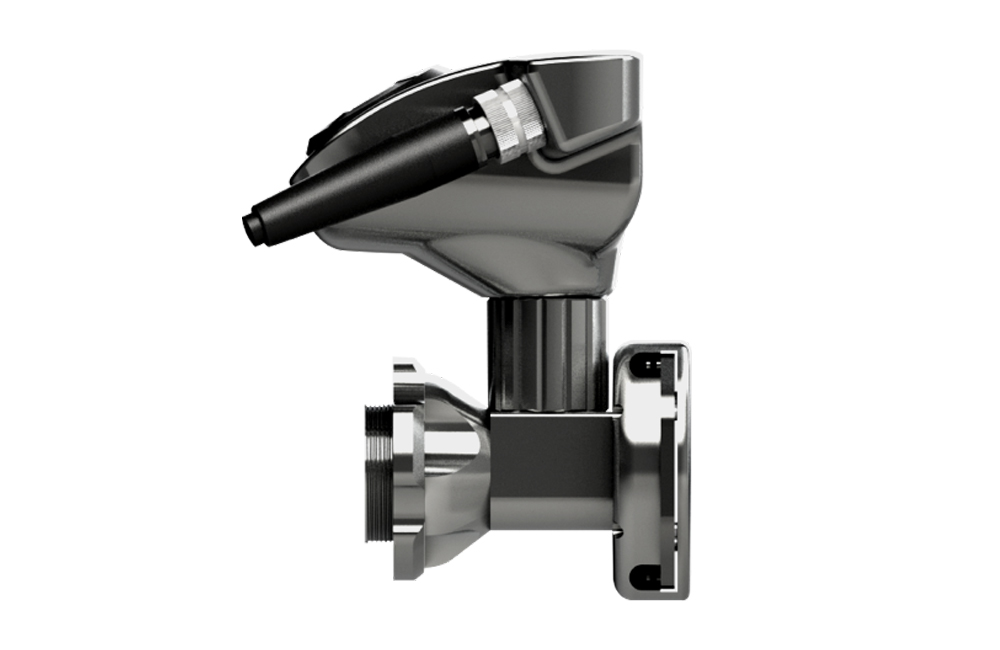

dexter, by DistalMotion

DistalMotion are in a similar position and set to disrupt the market, but with a slightly different go-to-market strategy. Their business model includes robot rental, plus recurring revenues from consumables.

The main attraction of this model is their surgical robot, Dexter, which is the first to offer adaptability in laparoscopic surgery.

Integrating seamlessly, without compromise, into existing laparoscopic procedures, the Dexter provides flexibility for surgeons to switch between robotic and laparoscopic methods quickly within the same surgical procedure.

Also offering cost-effective DaVinci equivalent products, DistalMotion are challenging Intuitive in both innovation and value.

Activ Surgical

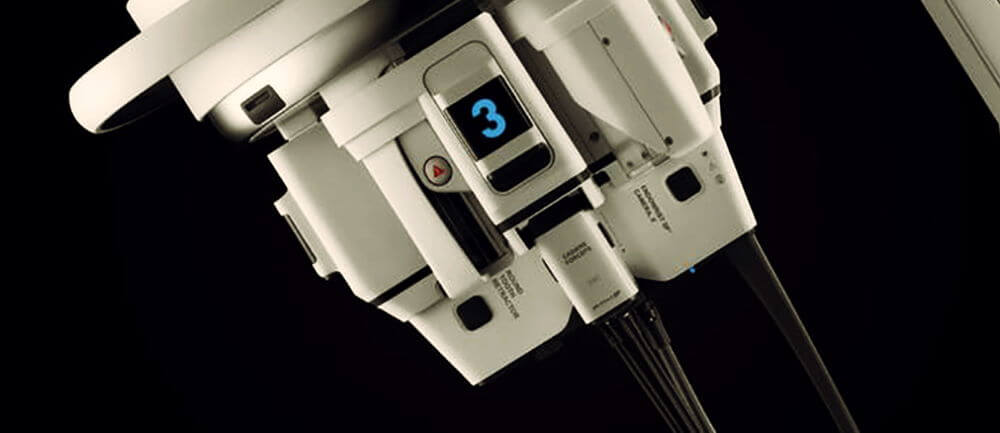

ActivSight, by Active Surgical

Also planning their first commercial launch, for Autumn 2020, Activ Surgical are incorporating computer vision, artificial intelligence, analytics and machine learning into their technology.

Their aim is to marry all these concepts together to improve surgical efficiency, accuracy, patient outcomes and accessibility for both endoscopic and robotically assisted procedures.

Activ Surgical work on the bleeding edge of robotics, having completed the world’s first autonomous robotic suturing of soft tissue in a live pig with their Smart Tissue Autonomous Robot (STAR).

STAR uses near-infrared fluorescent (NIRF) markers to provide a biocompatible, near-infrared 3D tracking system. This creates accurate 3D tracking of tissue and surgical tools, which has been argued to be an improvement over standard optical tracking technology.

Next up for Activ Surgical, is plans to bring their ActivSight system to market.

This system can activate any installed base of surgical visualization and robotics system to create real time intraoperative visual data and images. It’s a huge leap, providing data that’s not currently available to surgeons through existing technologies. The wealth of insight this system offers makes it extremely attractive.

Soon to be on the market, the ActivSight is likely to catapult Activ Surgical and provide interesting competition.

Now Intuitive’s reign of market dominance could be facing its biggest ever threat, with competition increasing over the next five years.

Already, we’ve seen this motivate innovation, with medical device giants Medtronic entering the frame with their much-awaited Hugo RAS system – claimed to be more flexible and cost-effective than any system on the market.

As more industry giants and growing companies like CMR Surgical, Distal Motion and Activ Surgical join the market, we’ll see the surgical robotics space advance both commercially and technologically. This is exciting news for everyone involved and, most importantly, will improve patient outcomes.

Recommended.

What Does Consumer Neurotech Innovation Mean for the Medical Device Industry?

Integrating systems into the human brain to control our everyday devices may seem very ‘Black Mirror’, but thanks to modern neurotechnology it's quickly becoming reality. Click to find out more.

How to Master Reimbursement in Medical Devices & Biotech.

In this live webinar, hosted by CM Medical, we went in search of expert reimbursement advice - speaking to Deborah Rizzi and Steven Haken of Odelle Technology.

How to Stand Out in a Saturated AI & Medical Imaging Market.

We asked an expert at an innovative medical imaging start-up about how they had overcome this challenge. Click now and listen to what they said.

Comments.